Payroll

How Does Payroll Work

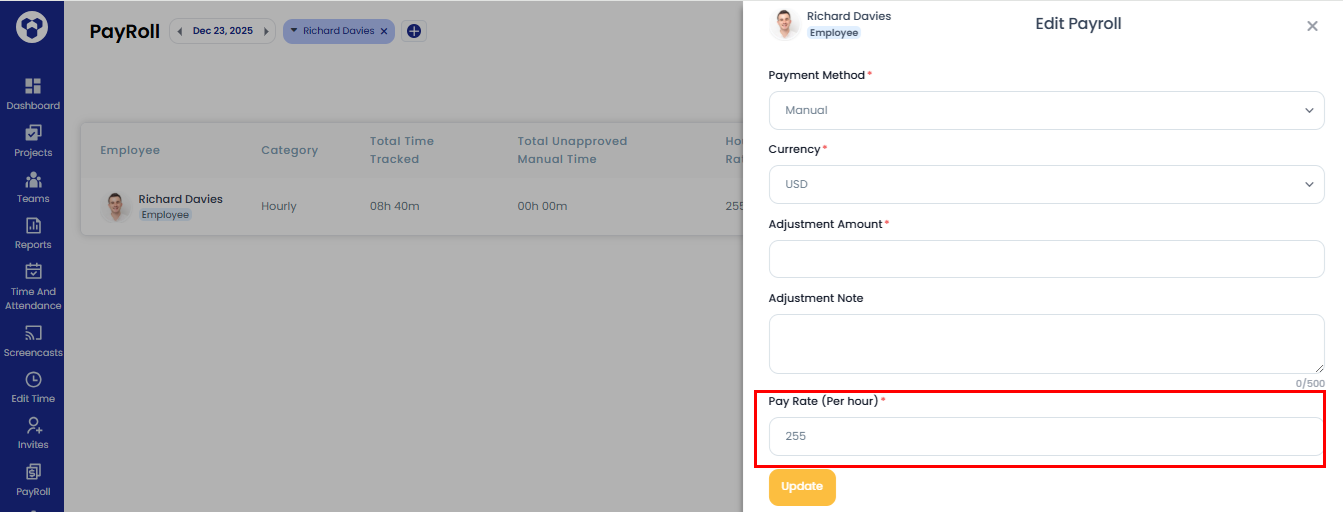

Payroll will be generated based on your tracking. You can generate payroll using pay rate.

Pay Rate:

We generate the pay rate in the following way.

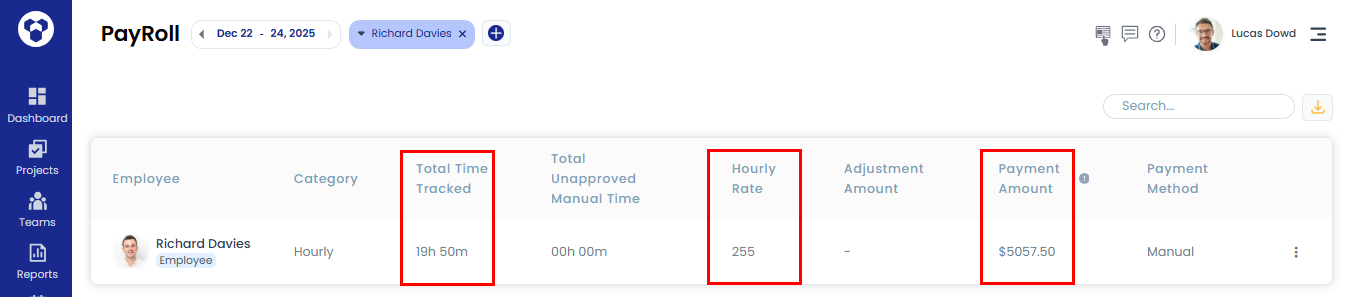

Calculation:

Example: If a user tracked 19 hours and 50 minutes (1,190 minutes) in one week, and the hourly rate is 255, then the calculation will be:

Salary for 1 min = Hourly rate/60 min = 255/60 = 4.25

Salary for 1,190 minutes (Total Payable Time) = Salary of 1 min = 4.25 * 1190 = 5057.5 =(Payment amount)

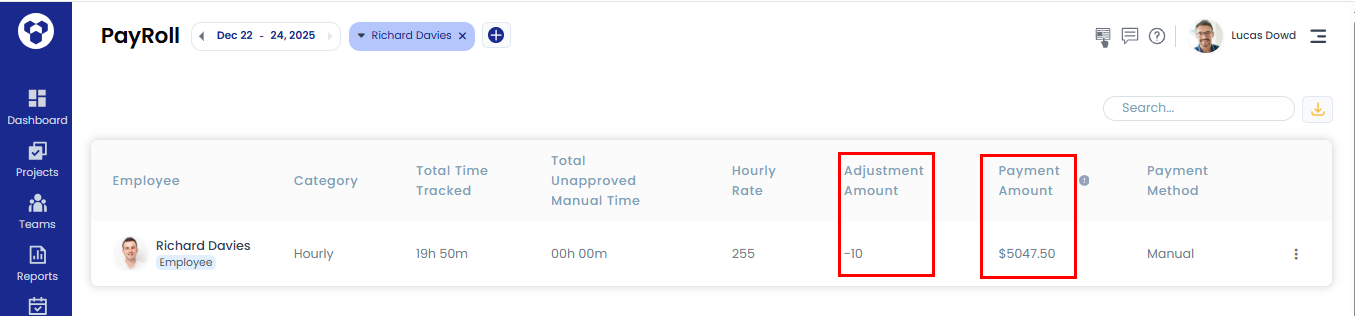

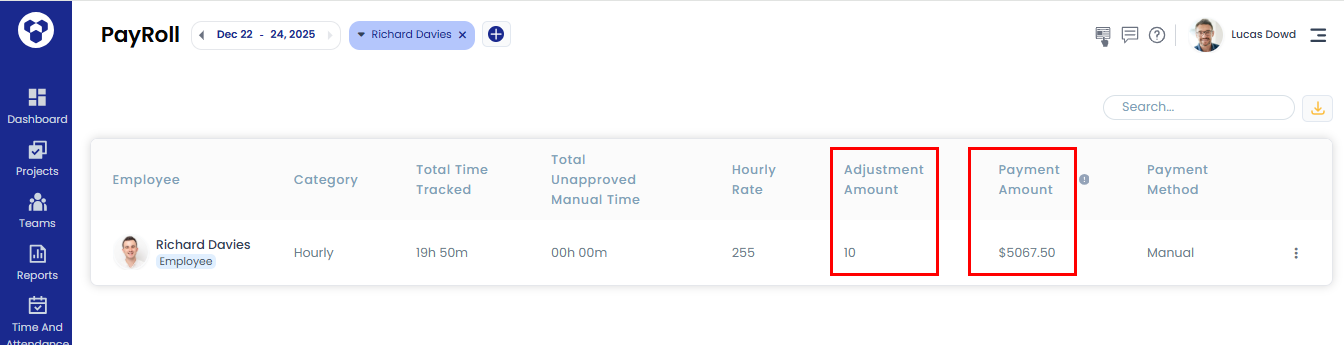

If the adjustment amount is positive, add it to the total payment amount. In the above example, the adjustment amount is 10 so total payment amount shall be: $5057.5 + 10 = $5067.5.

Note: If the adjustment amount is negative, subtract it from the total payment amount. For example: $5057.5 - 10 = $5047.5.